A Primer on What’s Coming Ahead in the Commercial Real Estate Market

Part 2 in a Series: Investment Strategies for a Post-Peak Economy

Earlier this year, I published an article on where the for-sale residential market is heading, and strategies and outlooks for home buyers and home sellers.I updated that article after the Union Tribune published mid-year housing data by zip code.

Since publishing the original article, many of the predictions have played out: we are now mid-summer 2019, the prime buying season for residential real estate, and in San Diego and other markets, there continues to be flat pricing, an increase in inventory, and slower sales.

This article, Part 2 in a series, is focused on commercial property investing. Commercial properties are properties that generate income for the owner, unlike a home. Commercial real estate in this context includes: apartments, office, retail, and industrial.

We are going to take a hard look at the numbers in order to understand cap rates and mortgage interest rates, and how these two variables largely determine the price an investor is willing to pay for an apartment building or other type of commercial building.

The bottom line: in today’s market, property investors must be seeking CASH FLOW, above all other investment metrics.

The other major investment metrics, aside from cash flow, include: price appreciation (equity growth), tax benefits, loan paydown (equity growth), and a hedge against inflation. 1 All of these are important. But in 2019 – 2020, Cash Flow is King.

Why is that? It is all about Cap Rates and Interest Rates. We’ll get into that. But first a quick discussion: I mean, isn’t it always about cash flow?

Not necessarily: there are markets, like San Diego and most of Southern California, the Bay Area, and New York, just to name a few, where there is rarely any immediate cash flow in commercial real estate investments. These are low cap rate markets.

People investing in those markets are rewarded by the other metrics, especially from rent growth and price appreciation. But now is a very dangerous time to rely on anything other than cash flow.

To understand why, let’s review what a cap rate is, and most importantly, what it means.

In plain English, the cap rate is the return, or yield, an investor will receive, if they buy a commercial building all cash, with no loan. 2

So if I pay, say $2MM for an apartment that generates $100,000 in Net Operating Income (NOI), 3 the Cap Rate for that building is $100,000 / $2,000,000 = 5%

So the equation of a cap rate can be written two ways:

Cap Rate = NOI / Value or…

Value = NOI / Cap Rate

These are the same equation, just re-arranged. If you know any two of the variables, you can solve for the third.

And here is a VERY IMPORTANT note: Cap Rates are determined by the market. So if I am an investor looking to purchase an apartment building, in a market where most apartments sell for, say 4% cap rates, then I can expect to pay a 4% cap rate, regardless of whether it’s a $750,000 acquisition, or a $3,000,000 acquisition. 4

And another important note: In the Cap Rate equation, the NET OPERATING INCOME (NOI) is assumed to be the actual performance of the building over the trailing twelve months. In other words, this number is a known entity, which determines the value of the building, depending on the current cap rate that investors are paying in the market.

So here is how the value of an apartment building with a trailing twelve month NOI of $100,000 will change, depending on the cap rates that investors are willing to pay:

In San Diego, cap rates have been hovering around 4%. So an investor can expect to pay $2.5MM for a building that generates $100,000 in NOI.

And here’s where things get interesting: if-and-when cap rates rise by one percentage point, say to 5%, the value of that same exact building drops by a whole 20% — from $2.5MM down to $2MM!

So now let’s circle back to interest rates, and mortgage rates, in particular. We know that when interest rates, determined by the Fed, rise or fall, mortgage rates are correlated and also rise and fall. The two are not the same thing, but they tend to move together.

Interest rates are currently at a historically low level. This was part of the Fed’s response to the Great Recession. Low interest rates can encourage businesses and individuals to borrow money and invest, which leads to more economic activity – new buildings, new equipment that increases productivity and income, more home buying, loans and credit used for home improvements, and other job-and-income creating investments. These new jobs and income then have a multiplier effect on the economy, with more people spending more money.

In contrast, the Fed will typically raise interest rates when inflation starts to go above their target of 2% per year. Higher rates mean: less borrowing, less investment, and lower values in real estate.

As of this writing, the Fed just dropped their interest rate, and it is possible will drop again in 2019 and 2020. This is a reversal of the policy they started in 2018, to slowly increase interest rates.

As real estate investors, we are extremely sensitive to increases in interest rates, and we are invested for the long-term. 5 So even though rates may stay low through 2019, perhaps even 2020, we must be prepared for when (not if) they will increase. Historically low rates will eventually increase.

What Happens to Commercial Real Estate When Interest Rates Rise

As discussed above, when Cap Rates increase, the value of a commercial property declines. That’s just pure math. And it brings us full circle, back to the theme of this article: Why Cash Flow is King.

Going back to our example of a building that generates $100,000 in Net Operating Income:

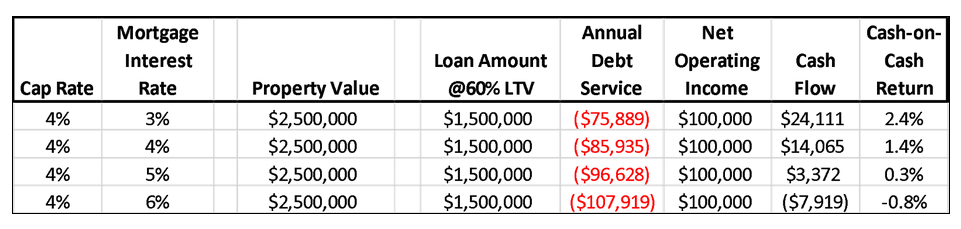

If you bought it when cap rates are 4%, and you have a mortgage at say 3% (that’s super low, for example purposes, realistically it’s probably 4% or higher!), your cash flow looks like this:

In the example above, with a 3% interest rate, the property is only generating a 2.4% cash-on-cash return. The cash-on-cash is the cash flow after debt service, $24,111, divided by the down payment of $1,000,000.

So if you are an investor in San Diego today, you will find similar opportunities in a 4% cap rate market: a property that generates $100,000 in NOI will cost you $2.5MM, with at least $1MM down payment, and you will receive $24,111 after paying all property expenses plus your mortgage.

Now let’s look at what happens to the Cash Flow and Cash-on-Cash Returns when the mortgage rates increase from 3% to 6%:

Recall the Net Operating Income is the cash flow before debt service. It assumes the owner has no mortgage, since some buyers are all-cash, some buyers can get lower interest rates than others, and others might choose a low Loan To Value (LTV) mortgage, say 50% or 60%, instead of a high LTV mortgage. The cap rate values the property independent of the loan. But if you get a loan, of course you need to pay the mortgage from the cash flow of the property.

The Cash Flow plummets! Using the 5% interest rate row above, the property that cost $2.5MM is only generating $3,372 in annual cash flow to the owner. One roof repair, or water leak, and that property is losing money for the year. 6

But it gets worse.

As we discussed, when mortgage interest rates rise, usually cap rates rise. So right when the cash flow decreases or even goes negative for the year, the value of the building plummets, as well:

Revisiting the Cap Rate equation, the property that an investor paid $2.5MM for, and is still generating the same $100,000 in annual NOI, is now worth $2MM when market cap rates go up to 5%, and only $1.67MM when cap rates increase to 6%.

So now that investor may be losing money with negative cash flow, and the value of the building has dropped. If they need to sell the building, they will lose the equity that they invested in the $1MM down payment. The sales price of $1.67MM pays off the loan of $1.5MM and pays for the transaction costs, commissions, and legal work needed. But almost the entire $1MM original investment is lost.

Even worse, this scenario can lead to foreclosures and bankruptcy.

Here’s Why Cash Flow is King

Now let’s look at an investor who purchases a property outside of a low-cap rate market like San Diego, New York, San Francisco, Los Angeles, and other markets.

Believe it or not, there are cities where investment properties trade at cap rates of 6%, 7%, and even 8% or higher. These cities are likely smaller, non-coastal, and have fewer real estate investors competing to purchase commercial properties. But they exist!

And….higher cap rates can also be achieved by investing in mismanaged, value-add properties with low rents. (more on that below)

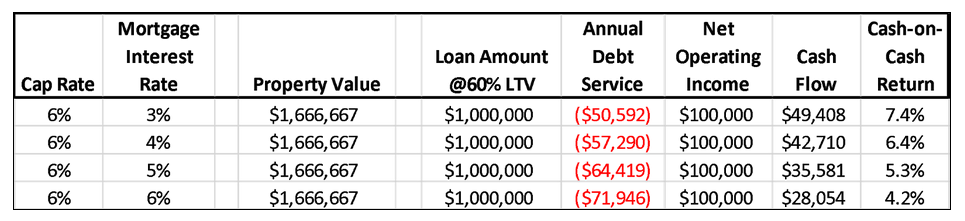

So let’s compare the downside protection that a building with strong cash flow provides:

In a market where 6% cap rates are normal, a property generating $100,000 in NOI will cost $1.67MM to acquire.

And the Cash Flow, even when mortgage rates rise to 6%, is great:

Most importantly, if cap rates rise above 6%, and therefore the value of the property drops below $1.67MM, the investor is protected because, as long as they’ve locked in a mortgage rate as high as 6% (way above current rates), they can still service the loan, make plenty of cash flow every year, and there is no need to sell the property for a loss.

So How Do Investors Find 6% or Greater Cap Rate Properties?

All this math is great, in theory, but in a 4% cap rate environment, it may seem like wishful thinking. Experienced investors may be thinking: Great, but where can I find a 6% cap rate property?

There are two primary ways to find cap rates 6% or greater. The first is:

Find properties that are being mismanaged, have high operating expenses, and/or rents that are below market.

These properties are usually off-market, meaning not listed with a big brokerage, and the owner is self-managing the property instead of working with a professional property management team.

These will typically require a substantial additional investment to bring the properties up to contemporary finishes, add new amenities, or make other improvements in order to raise the rents and decrease operating expenses, resulting in a scenario like these:

The property acquired at a 4% cap rate is now generating a 5% or even 6% yield – as the owner’s new cap rate, after the buyer raised rents and decreased costs by investing an additional $200,000 into the property.

And here’s how much value those improvements created. Assume that the overall market is still selling at 4% cap rates. With the new Net Operating Income of either $135,000 or $163,000 as shown in the example, the property is now worth:

Therefore, the value created (profit) under these two scenarios is: 7

So by finding a mismanaged, value-add property, injecting $200,000 to improve it, and raising rents and decreasing expenses, the value has gone way up and the cash flow is now much higher. That investor can sell for a big profit, or hold the property long term for cash flow. Their downside is protected!

Should I buy Class A or Class C?

Often the properties that trade at the lowest cap rates are considered “Class A.” This means they are the newest, in the best locations, with the best interior finishes and property amenities. There is very little “value add” opportunities to Class A properties. Investors who purchase these properties do so because they view them as “safe” and are willing to take a lower return for the perceived lower risk. But the exact opposite is true!

Without a value-add component, the Class A property, purchased at a 4% cap rate, with top-of-the-market rents and efficient operations through professional management, will be hit the hardest in terms of both cash flow and value, when interest rates rise.

The second way investors can find cap rates of 6% or greater is to go outside of San Diego and other low-cap rate markets. In many cities, 6% or greater is the norm!

I will talk about these markets in future articles. But one tip: I have personally invested in a Mid West city that has great economic indicators, has a growing population and jobs, and 6% or greater cap rates are the norm. In fact, if one looks hard enough, even 8%, 9%, and 10%+ cap rates are achievable in this market.

Conclusions

This article is meant to give all real estate investors – beginning, intermediate and experienced – the mathematical explanations on why Cash Flow is King in the current economic cycle.

- There are many metrics that investors use when evaluating an investment property. These include: cash flow, price appreciation, tax benefits, and inflation hedges. I will discuss these in greater depth in my next article in this series.

- In a low cap rate and low mortgage rate environment, investors can see their cash flow eroded and the values plummet if interest rates tick up by just 1% or 2%.

- Properties with strong cash flow, generally defined as cap rates at least 2% higher than the current mortgage rates, are insulated from the macro-economic risks of rising interest rates. These properties:

- Can continue to service their debt and make the owner a positive annual cash flow

- If values go down because interest rates go up, there is less risk of foreclosure. The owner does not need to sell, and can continue to hold the asset for the long term

- The opposite occurs when investors acquire properties in a low cap rate, low mortgage rate environment, as we’re currently experiencing. Investors face great downside risks:

- No cash flow, and not being able to pay the mortgage

- Plummeting property values when interest rates tick up 1% or 2%

- Risk of foreclosure and even bankruptcy

- Investors can find better cap rates, even in a low cap rate and low interest rate environment, by:

- Buying value-add properties, and increasing the Net Operating Income

- Investing in non-coastal markets, where cap rates are generally higher

About MV Properties and Keegan McNamara:

MV Properties exists to serve our clients in building their wealth through real estate investments.

We guide our clients through creating customized real estate investment strategies.

We analyze our clients’ portfolios, looking at Return on Equity, debt strategies, and tax efficient planning, to develop a plan specific to each clients’ needs.

We let the numbers tell us the strategy, as each situation is different.

Keegan McNamara is a real estate investor, developer, and broker. He owns MV Properties, a residential brokerage and property management firm, and McNamara Ventures, a development and investment company. Keegan can be reached at keegan@mcnamaraventures.com

[ 1 ] My next article in this series goes into greater depth on these concepts, it is titled “5 Ways Real Estate Investors Make Money.”

[ 2 ] We build in financing assumptions after the cap rate calculation

[ 3 ] Net Operating Income is defined as the total income from the property in a given year, minus all of the costs to operate that building, except debt service. These costs include: property taxes, property management fees, repair expenses, utility costs, landscaping, marketing, and other property-level expenses.

[ 4 ] That’s a mild over-simplification: apartments in more desirable locations, and newer buildings, will sell for lower cap rates, all else being equal, to apartments in worse areas or older buildings that may be due for major maintenance.

[ 5 ] Real estate assets are illiquid, and often have big pre-payment penalties on the mortgages. So as investors, we must plan to own the asset for several years at a minimum. Contrast this to say, a publicly traded stock, which can be bought or sold 24 hours a day, 365 days a year.

[ 6 ] Experienced real estate investors know that Debt Coverage Ratio (DCR) is an important factor in determining the loan amount, LTV. The above example assumes the original loan was made at 3% floating rate, at a DCR of 1.32x, and the rate subsequently rose to 5% or 6%.

[ 7 ] “Profit Upon Sale” is simplified and does not include transaction sales costs, nor the positive cash flow that was generated to the owner.